AST Announces IP3 2019 Results

Fixed Price, Fixed Term Industry Patent Purchase Program Brings Leading Technology Companies Together for Most Successful IP3 Yet, Purchasing Patents for Nearly $5 Million

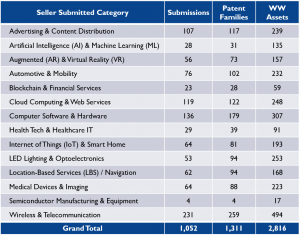

Princeton, New Jersey, March 10, 2020 – AST, the member-driven leading provider of proactive and collaborative patent defense solutions, today announced the results from IP3 2019, a fixed price, fixed term, collaborative patent buying program. IP3 2019 is the latest iteration of AST’s Industry Patent Purchase Program (IP3), which provides patent owners access to dozens of leading technology companies by streamlining the process of selling patents with a fixed price, rapid response model. IP3 2019 focused on soliciting patents from the following technology areas:

- Advertising & Content Distribution

- Artificial Intelligence (AI) & Machine Learning (ML)

- Augmented (AR) & Virtual Reality (VR)

- Automotive & Mobility

- Blockchain & Financial Services

- Cloud Computing & Web Services

- Computer Software & Hardware

- Health Tech & Healthcare IT

- Internet of Things (IoT) & Smart Home

- LED Lighting & Optoelectronics

- Location-Based Services (LBS) / Navigation

- Medical Devices & Imaging

- Semiconductor Manufacturing & Equipment

- Wireless & Telecommunication

Similar to previous IP3 programs, IP3 2019 attracted strong interest from both patent sellers and Members, with nearly twice as many patent portfolios compared to 2018, and 24 Operating Companies collaborating on purchases. Participants in IP3 2019 included Cisco, Facebook, Google, Honda, IBM, Intel, Microsoft, Oracle, Philips, SAP, Uber, and Verizon, among others, with nearly $5 million spent to acquire 53 patent families.

“IP3 2019 was our most successful iteration of our fixed price, fixed term patent purchase program to- date, with more participants, more capital committed from our Membership, and more patent families acquired,” said Russell W Binns, Jr., CEO of AST. “Our Membership, which includes many of the world’s leading technology companies, finds IP3 an easy, streamlined way to apply capital, make purchasing decisions, and acquire patent rights to mitigate risk. The IP3 program complements our standard purchasing process very well, as some deals are better situated for a fixed price program while others may be more complicated needing negotiations and many changes to the patent purchase agreement.”

Results Summary

- Purchased Deals

- 45 deals acquired

- 53 families, 91 U.S. Patents, 113 active assets

- Prices ranged from $1,000 to $450,000

- price per patent family – approx. $96k

- (Compared to $99k in IP3 2018, $128k in IP3 2017, and $96k for IP3 2016)

- 24 Members contributed to acquisitions

- 45 deals acquired

- AST closed all 43 of the deals before the year-end, 2 were delayed due to seller issues

IP3 2019 Submission Stats

1,052 IP3 Submissions by 338 Patent Owners

- Over 1,300 submissions were received out of which 250+ submissions were rejected or excluded from program due to subject matter, family issues, etc.

- Almost double the number of total submissions compared to IP3 2018

- 1,052 valid submissions published as potential AST deals

- 1311 patent families with 2,816 active assets from 38 jurisdictions

- 2,546 issued patents, 211 published apps, 59 unpublished apps

- 1,973 US assets – 1,795 issued patents, 178 pending applications

- 88% or 926 submissions were single patent family offerings

- 117 submissions with 2-5 patent families

- 9 submissions with more than 5 patent families

- 65% or 683 submissions had at least one previously offered asset to AST

- In IP3 2018, 75% of all submissions were previously received.

Patent Portfolio Submission Stats

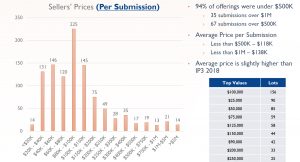

IP3 2019 Price Expectations – $1,000 to $350M

Median Seller’s Price Expectation = $100,000

45 IP3 Deals Purchased – $1,000 to $450,000

Average Purchase Price for IP3 = $107,933

Purchase Summary

- 45 AST deals purchased in IP3 2019 which included 113 active patent filings in 53 families

- 91 US Patents, 6 US Applications

- 16 non-U.S. patents – 2 China, 1 Germany, 3 EPO, 1 France, 2 Great Britain, 1 Japan, 1 Korea, 5 Taiwan

- Average 2.5 assets per family (compared to 1.7 in 2018, 3.6 in 2017, and 1.8 in 2016)

- 28 deals with single US patent

- 6 deals with 2 US patents

- 8 deals with 3 or more US patents

- 9 deals with at least 1 foreign patent

- 34 different sellers and 8 brokers

- 22 out of 45 purchased deals were from Brokers/Intermediaries

- Type of Sellers –

- 16 deals from Non-Practicing Entity/Patent Holding Company

- 14 deals from Practicing Entities

- 10 deals from Individual Inventors

- 5 deals from Universities and R&D Institutes

IP3 2020

AST is preparing for IP3 2020 later in the year, with a submission window opening on July 6, 2020. IP3 2020’s technology areas will be decided in the coming months, but we expect to have similar technology areas along with a similar schedule to IP3 2019.

About AST

AST was founded in 2007 by four global high-tech companies as a member-driven cooperative to mitigate patent risk and to operate with no profit motive. AST serves the world’s most innovative and recognized technology companies through cost-sharing acquisition of patent rights; provides access to the most comprehensive database of patents offered in the secondary market; offers Quarterly Market Insights reporting; and facilitates a community for IP thought leaders to interact and form business relationships. AST’s Members include top global companies from a wide range of industries including Cisco, Ford, Google, Honda, IBM, Intel, Microsoft, Oracle, Philips, SAP, Sony, Spotify, Uber and Verizon.